Currently, central transfers for example KuCoin and decentralized transfers such Uniswap don’t collect KYC (Know Your own Customer) advice away from profiles. If you’ve produced transfers involving the purse and you may a centralized replace membership which is related to the term, it’s likely that the brand new Irs can pick your bag address. In recent years, the newest Irs has increased its funds to handle taxation ripoff. Specifically if you use your Ledger along with other purses including MetaMask, Phantom, and you can Electrum in the first place, up coming Ledger Labs wouldn’t be able to gather any investigation. One, and you may Ledger Laboratories doesn’t know your own bag details to start with as your purses is actually generated at random traditional. This will make it an easy task to control your tokens and you will interact with certain programs without the need to button anywhere between some other software or extensions.

Certain jurisdictions can offer taxation exemptions based on cash amounts otherwise holding stage. Join five hundred,one hundred thousand somebody quickly calculating its crypto taxes that have CoinLedger. You can attempt from app and you may make a examine away from their gains and losings totally free of charge by simply making an account. More credible crypto exchanges efforts lower than strict Discover Your own Customer (KYC) and you can Anti-Currency Laundering (AML) laws. Such regulations wanted exchanges to get personal information off their profiles, which is distributed to tax regulators in the event the requested. Hence, all really-understood exchanges, specifically those operating in the U.S. otherwise serving U.S. customers, have a tendency to are accountable to the newest Internal revenue service to some extent.

Over the past very long time, the newest Irs have granted subpoenas to several crypto transfers purchasing him or her to reveal some representative accounts. On the various other celebration, the fresh Irs subpoenaed Bitstamp to produce more info in the an excellent taxpayer just who submitted an amended get back and you will asked a $15,475 refund. The cost basis out of a secured item is the brand new buy otherwise buy rate, that is used so you can calculate financing progress otherwise loss. Crypto debit credit payments are a good taxable knowledge, it doesn’t matter if you’re using a traditional debit cards otherwise a great cryptocurrency-dependent you to definitely.

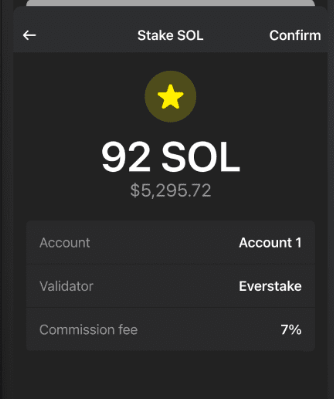

This really is especially useful for users who are in need of an additional covering of defense due to their crypto assets. Phantom’s user interface are smooth and you will easy to use, definition you spend a shorter time figuring something away and much more day learning the brand new dApp ecosystem. The newest purse brings a simple structure for sending, choosing, staking SOL, and you will trading their crypto, and can easily be linked within this Solana dApps and then make your deals frictionless. The new Phantom Purse Tools Handbag is actually a-game-changer for crypto shops.

Phantom wallet extension | You still need to estimate progress/losses

- This can be an area to post one suggestions, reports, or questions regarding the new Solana blockchain.

- The newest Irs spends sophisticated software and collaborates along with other companies, both domestic and you can global, to gather research to the crypto transactions.

- Using crypto for example ether so you can initiate fuel are a good nonexempt exchange.

- The new number said for your requirements by a move on the Function 1099-MISC such as staking earnings, desire earnings & perks money perform embark on range 8z away from Agenda step 1.

- Putting this information in advance will help you statement truthfully if the brand new legislation implement.

It indicates you’ve got satisfaction realizing that everything you see to the display screen is really what you happen to be finalizing. Phantom Purse brings a very clear and easy software that enables your to view what you owe around the multiple cryptocurrencies to your main screen. The fresh Phantom Wallet Equipment Wallet is a concise equipment that suits in the hand of your hand, so it’s simple to hold to you wherever you go. Additionally it is very user friendly, which have a straightforward interface you to definitely goes from the options procedure. Please be aware one to current email address interaction to your business through this webpages do not perform a legal professional-client relationship between you and the business. Don’t send one privileged or confidential suggestions on the business through this webpages.

How to report their Phantom Bag taxes automatically

The fresh Phantom Bag resources purse is a wonderful choice for those people who wish to perform the SOL tokens safely. It’s a non- phantom wallet extension custodial bag, so that you provides command over your personal important factors plus don’t forfeit child custody so you can an alternative entity. In order to import finance, backup the Phantom purse target and insert it as the brand new recipient address in another wallet, such as Nuclear Wallet, and show your order. Just after downloading Phantom Bag, you will end up directed because of undertaking a new bag, that requires promoting a safe vegetables words you need to store properly. You’ll need to make a safe seeds words, a couple of several terminology you have to shop safely in order to recover your own purse if you eliminate access to their tool otherwise ignore your own password.

Within this publication, i get acquainted with Phantom’s income tax revealing rules within this You. We’ll along with break down a simple way to statement the Phantom fees in minutes. This will allow Internal revenue service (and also you) observe the investment progress and losses a lot more certainly, the same as exactly how brokerage companies report inventory deals. The brand new brief response is yes, however the info have altered inside the a large way. Performing January step one, 2025, Coinbase first started reporting certain crypto exchange information to the fresh Irs to your an alternative tax setting, Mode 1099-DA. Which scratches the most significant change yet within the crypto taxation revealing laws and regulations, and it will impression scores of U.S. crypto users.

Hedera Resources Handbag Book: Safe HBAR Shop Possibilities

Rather than seeking to hide your cryptocurrency, here are a few our help guide to avoiding crypto taxation lawfully. Recently, the fresh Irs has increased scrutiny on the cryptocurrency transactions. In the 2020, an alternative concern is put in Form 1040 you to particularly questioned taxpayers whenever they transacted in the cryptocurrency in the tax seasons.

Thus, development or loss in the product sales otherwise replace from cryptocurrency have to end up being claimed. Phantom deals are publicly filed to the blockchain, which makes them fully traceable from the Irs. The brand new Internal revenue service uses complex record solutions to display screen crypto interest and you will impose income tax conformity.

While the the purchases for the blockchain is clear, he could be trackable, and also the income tax regulators have got all the newest methods to monitor economic hobby. Phantom bag get declaration your crypto purchases to your Internal revenue service, but it does perhaps not automatically deduct taxation from trades. You ought to opinion Phantom’s taxation reporting principles for more information on how the deals may be inspired.

This form account the complete worth of deals to the system which can be intended to encourage taxpayers of the obligation in order to statement money. The brand new landscape of cryptocurrency could have been always developing to your broadening analysis by tax government, particularly the Internal revenue service (IRS) in the united states. Consequently, crypto people and you can buyers are often interested in learning the brand new revealing strategies of numerous exchanges. ” is a packed you to definitely, which have implications between privacy issues to help you income tax financial obligation. If an employee is actually paid off that have digital possessions, they should report the value of property obtained since the earnings.

But not just which they wear’t — (even though we can’t be sure it our selves) it’s extremely likely that they also is’t. All of the suggestions authored on this site is offered inside the good faith and for general just use. We can’t make sure the completeness or reliability very delight have fun with caution. One action you’re taking in line with the guidance available on cgaa.org is strictly at the discretion. CGAA will not be accountable for any losings and you will/otherwise injuries incurred by using everything given.