Posts

Issues range from the average everyday bank equilibrium, the amount of your own dumps and the frequency with which your make use of your account. Occasionally, you could potentially install an advance loan software and you will receive the money all of the for a passing fancy time. Other programs takes a day or two to confirm their private and you will banking information, or you may ho ho tower symbols need to hold off a short while to get the mortgage for those who don’t have to pay an expedited transfer percentage. Very cash advance apps require that you have direct put to possess your paychecks. But if you’re also a concert employee otherwise freelancer or wear’t have access to head deposit, it can be a stumbling-block if you want more cash to get to pay day. Bankrate research more than 100 banks and you will borrowing unions, along with a number of the largest creditors, online-only banking companies, regional banks and credit unions which have each other discover and restrictive subscription principles.

The new donor compensation can vary out of 700-1000 for the first month. Significantly, the fresh contour differs from one to heart to a different, sometimes even from one few days to a different. Concurrently, its recommend-a-buddy buddy bonus program perks your with 50 for each pal you are free to donate double. This can be ‘the best using plasma cardiovascular system close myself’ if you live inside Knoxville and Maryville within the Tennessee, Conyers, Dallas, and you will Kennesaw within the Georgia, Goose Creek and you will Myrtle Coastline inside Sc, and you will Hammond in the Los angeles. For each example requires to 2 hours or smaller and will getting regular double a week.

Ho ho tower symbols: Today look at your email

- Occasionally, yes — especially if the individual is really-prepared, understands the newest words, and that is comfortable handling multiple membership.

- Since the reduce was just launched, savings prices haven’t but really altered.

- Note that our very own study is actually performed to have specific examining profile, maybe not for banking companies overall.

- You.S. Bancorp cycles from the better four, managing more than 500 billion in the deposits.

- I’ve as well as taken into consideration how long it needs to get their incentive once you qualify and you can indexed when for each render expires.

Make use of this interactive map for the best plasma contribution stores near you. When you’re qualified and you may ready, you can give twice per week and this brings in you from 160 – 800 and you will over per month. Consume adequate healthy protein, especially beef, your day pre and post donating plasma! Criteria to own plasma contribution can vary in one location to another. Variations mostly ability inside the age brackets, body weight, disease, and other things which affect the human body in one single method otherwise other, such as, looks piercings and you can long lasting makeup. Concurrently, donors earn respect items to the iGive Rewards System that will getting used for cashback.

Find the best Higher-Produce Checking Accounts Out of 2025

It takes merely a couple of minutes to make use of to start an Alliant certification totally on the web. Select from multiple conditions away from 3 to help you sixty months, deposit a minimum of step 1,one hundred thousand (75K for jumbo), following sit down and see your finances substance monthly that have an APY as high as 4.15percent for a good several-week identity. For those who discover a business Basics Membership, you’ll have to put at least 5,100000 in the the fresh currency within this 1 month, that’s bucks out of a source additional U.S.

- For those who deduct their actual costs, your own facts need to reveal the costs from functioning the automobile you to try in person related to a charitable mission.

- Noninterest-affect examining improved 32.step 3 million, money business enhanced 684,000, and you can deals enhanced 691,100 to your nine days finished Sep 29, 2025.

- For those who itemize your own deductions, you could potentially subtract dos,900 for the contribution.

- Come across and therefore 10 Cds showed up at the top and discover when you should opt for a different type of checking account.

And, of course, spending to the credit can help otherwise harm your credit score, depending on how you utilize it. Discover a great Synchrony High Yield Family savings and begin making 3.80percent APY today. Should your offers are only hangin’ call at a minimal-attention membership, not really undertaking far… really, that’s kind of a pity, proper? Render your finances a tiny determination and give it time to build when you are you kick back.

Some days, they can be always lose present balance for the handmade cards. Repeatedly, have which might be entitled advantages, and therefore suggest a fee for previous behavior, are extremely merely offers to possess future costs. Since the offers are finest for brand new consumers, otherwise “the newest money,” it can be great for move currency between financial institutions discover the individuals economic advantages. This is extremely simple if you reside in the an area that have additional banking institutions on every corner, along with a big emergency financing. However, basic, be sure to ask your current financial to suit the other also offers.

Just what are My Rights since the a Taxpayer?

For many who produced several contribution of 250 or higher, you must have possibly another acknowledgment for each and every or one receipt that displays their full contributions. A 30percent restrict relates to bucks efforts which can be “for the usage of” the new qualified groups unlike “to” the new licensed organization. Find Benefits for the 2nd group of licensed groups and the application of one accredited business, afterwards, below Limits according to 30percent from AGI, for more information. The product quality insurance amount is 250,100000 for every depositor, for every insured financial, per membership possession classification. Customers have a variety out of alternatives for where they can put their money and how they can availability banking products and services. But not, FDIC put insurance policy is only available for cash to the put from the an FDIC-insured bank.

Write-offs More than five hundred but not More than 5,one hundred thousand

Using this account, people will get around eight early direct dumps per month, to own degrees of ten,000 or quicker. At the same time, the savings account stability earn a small produce, so there are not any hoops in order to dive through to earn the brand new speed. So you can be eligible for an excellent Citibank extra, you’ll need to start by beginning an eligible checking account. Currently only the Normal Family savings (as well as those who are also lifestyle trust or custodial profile) is regarded as eligible for the brand new increased head put extra. Both, it may be, but ensure that the account will probably be worth your time regarding the long lasting. Should your extra includes a bank account that has a great large monthly fee, you’ll get into the newest red sooner or later.

So what does Saturn Biography Shell out?

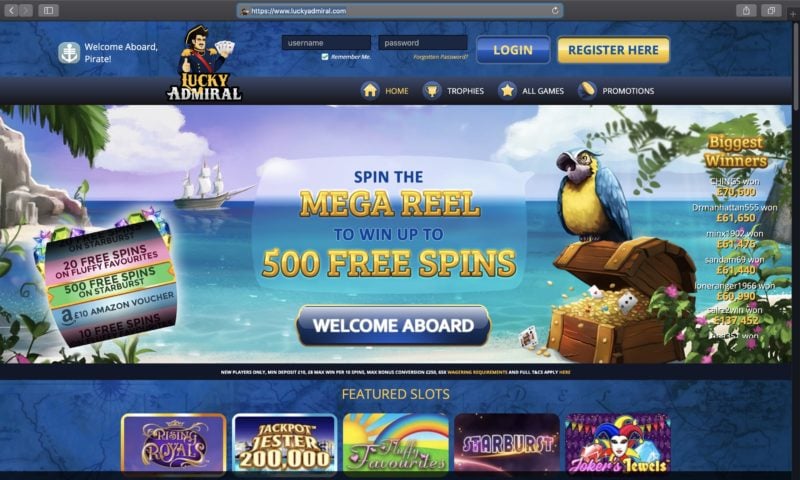

The utmost payment might possibly be step 1,400 for each personal and can are very different considering points, with regards to the Irs. The fresh service could make an estimated overall of about 2.cuatro billion within the costs. The new Internal revenue service intends to topic automatic “unique repayments” of up to 1,400 to a single million taxpayers doing after that it day, the new department revealed last week. After earliest deposit, discovered a supplementary one hundred totally free spins to have a great passing appreciate video game, and you can a good 100percent provides incentive around a hundred. In order to claim, sign up for another registration, plus the 10 100 percent free spins was repaid quickly.